Understanding US Bank mortgage rates can be crucial for anyone looking to buy a home or refinance an existing mortgage. This article delves into the latest trends in mortgage rates, factors that influence them, and how different types of mortgages compare. You’ll learn how to qualify for the best rates and receive tips on selecting the right mortgage for your needs. Additionally, we explore specific mortgage rate offerings from US Bank and provide insights from customer reviews and experiences. By the end, you’ll have a comprehensive understanding of what to expect from US Bank mortgage rates and how to make informed decisions for your financial future.

ugodj.com invites you to explore this topic thoroughly.

1. Introduction to US Bank Mortgage Rates

Navigating the mortgage landscape can be daunting, especially when trying to understand the intricacies of US Bank mortgage rates. This introduction aims to demystify these rates, providing you with the essential knowledge needed to make informed financial decisions. US Bank, a prominent player in the mortgage industry, offers a variety of mortgage products with competitive rates tailored to meet diverse borrower needs. Mortgage rates are influenced by a range of factors, including economic conditions, federal monetary policies, and individual borrower profiles. By grasping these basics, you can better appreciate how rates fluctuate and what drives these changes.

Understanding US Bank’s mortgage rates involves more than just knowing the current percentages; it requires a comprehensive look at the broader economic context and how personal factors such as credit scores and income levels play a role. Additionally, US Bank provides different types of mortgages, each with unique terms and rates, catering to various financial situations and long-term goals. This section will serve as a foundation, preparing you to delve deeper into the specific offerings, trends, and tips that will help you secure the best possible mortgage rate from US Bank. Whether you are a first-time homebuyer or looking to refinance, this guide will set you on the right path.

2. Overview of current mortgage rate trends

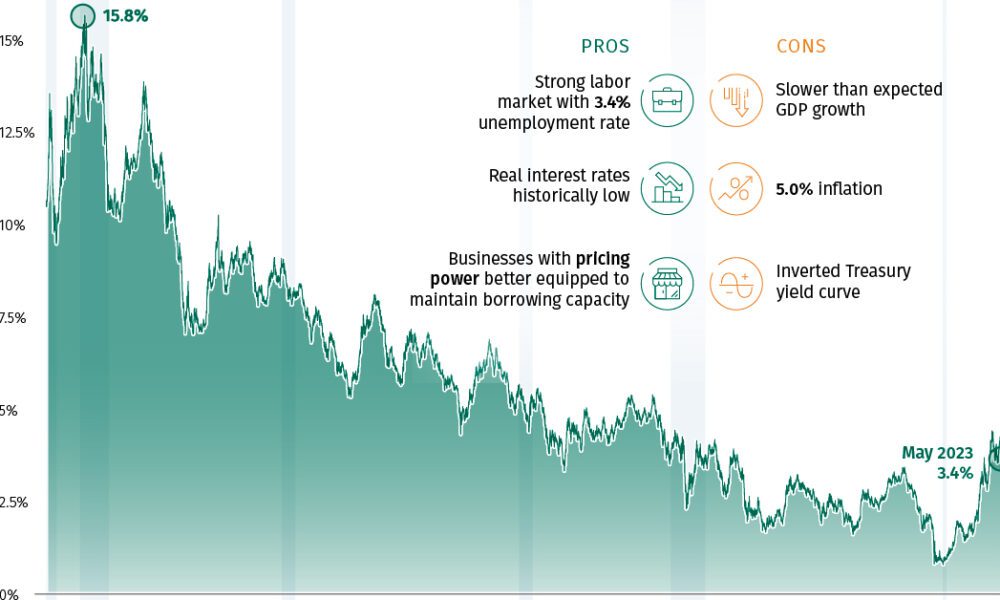

The current mortgage rate trends reflect a dynamic and ever-changing economic landscape. Over recent months, mortgage rates have shown fluctuations driven by a mix of economic indicators, policy decisions by the Federal Reserve, and global financial trends. Typically, when the economy is strong, mortgage rates tend to rise due to increased demand for loans and higher inflation expectations. Conversely, in times of economic uncertainty or downturns, rates often fall as the demand for borrowing decreases and the Federal Reserve aims to stimulate economic activity through lower rates.

For potential homebuyers and those looking to refinance, staying informed about these trends is crucial. Recently, there has been a slight upward trend in rates, influenced by factors such as inflation concerns and shifts in monetary policy. However, rates remain relatively low compared to historical standards, presenting ongoing opportunities for borrowers. By keeping an eye on these trends, you can better time your mortgage decisions to secure favorable rates, ultimately impacting the affordability and long-term cost of your home loan.

3. Factors influencing mortgage rates

Several key factors influence mortgage rates, shaping the cost of borrowing for homebuyers and those refinancing. Economic conditions play a significant role; during periods of economic growth, mortgage rates tend to rise due to increased demand for loans and higher inflation expectations. Conversely, in economic downturns, rates often decrease as borrowing demand drops and the Federal Reserve implements lower rates to stimulate the economy.

Federal monetary policies are another critical factor. Decisions by the Federal Reserve, such as adjusting the federal funds rate, directly impact mortgage rates. Additionally, inflation levels affect rates; higher inflation typically leads to higher rates to maintain lender profit margins.

Individual borrower profiles also influence mortgage rates. Lenders consider factors such as credit scores, debt-to-income ratios, and employment history when determining rates. Borrowers with strong credit and financial stability are often offered lower rates, reflecting their lower risk to lenders. Understanding these factors can help borrowers better navigate and potentially secure favorable mortgage rates.

4. Comparison of different types of mortgages

When comparing different types of mortgages, it’s essential to understand how each type can impact your financial situation and long-term goals. The two primary mortgage categories are fixed-rate mortgages and adjustable-rate mortgages (ARMs). Fixed-rate mortgages offer a consistent interest rate throughout the loan term, providing stability and predictable monthly payments. This type is ideal for borrowers planning to stay in their homes for an extended period, as it safeguards against market fluctuations.

In contrast, adjustable-rate mortgages (ARMs) start with a lower initial rate that adjusts periodically based on market conditions. This means your monthly payments can change over time. ARMs are beneficial for those who expect to sell or refinance before the adjustable period begins, potentially taking advantage of the lower initial rate.

Another option is the interest-only mortgage, where borrowers pay only the interest for a specified period before starting to pay both principal and interest. This type can be attractive for those with variable incomes or who plan to invest the savings from the lower initial payments elsewhere. However, it carries the risk of higher payments once the interest-only period ends.

Government-backed loans, such as FHA, VA, and USDA loans, offer alternatives for specific borrower groups. FHA loans are designed for low-to-moderate-income borrowers, offering lower down payment requirements. VA loans cater to veterans and active military members, often with no down payment. USDA loans target rural homebuyers with low-to-moderate incomes, providing low-interest rates and no down payment.

Understanding these mortgage types enables you to choose the one that aligns best with your financial situation and homeownership goals.

5. How to qualify for the best mortgage rates

Qualifying for the best mortgage rates involves several key steps to ensure you present yourself as a low-risk borrower. Start by maintaining a high credit score, typically 740 or above, as lenders use this to assess your creditworthiness. Regularly check your credit report for errors and take steps to improve your score by paying down debts and making timely payments.

Next, aim for a low debt-to-income ratio (DTI), ideally below 36%. This ratio compares your monthly debt payments to your gross monthly income, indicating your ability to manage additional debt. Lenders favor borrowers with stable employment and income history, so maintaining consistent work can improve your chances.

Saving for a substantial down payment, typically 20% or more, can also secure better rates by reducing the lender’s risk. Additionally, having significant savings or liquid assets demonstrates financial stability. Shopping around and comparing offers from multiple lenders allows you to find the most competitive rates. By focusing on these factors, you can enhance your eligibility for favorable mortgage rates.

6. Tips for selecting the right mortgage rate for you

Selecting the right mortgage rate involves careful consideration of your financial situation and long-term goals. Start by assessing whether a fixed-rate or adjustable-rate mortgage (ARM) suits your needs. Fixed-rate mortgages offer stability with consistent payments, making them ideal for those planning to stay in their home long-term. ARMs, with lower initial rates that adjust over time, might be suitable if you anticipate moving or refinancing before the rate adjusts.

Consider the loan term length. While shorter terms like 15 years typically have lower rates and save on interest, they come with higher monthly payments. Longer terms, such as 30 years, offer lower payments but accrue more interest over time.

Evaluate the overall cost of the mortgage, including interest rates, fees, and closing costs. Sometimes a loan with a slightly higher rate but lower fees is more cost-effective. Use mortgage calculators to estimate monthly payments and compare different scenarios.

Additionally, think about your financial stability and risk tolerance. If your income is variable, a fixed-rate mortgage may provide peace of mind. For those with more financial flexibility, an ARM could offer initial savings.

By carefully considering these factors, you can select a mortgage rate that aligns with your financial goals and circumstances.

7. Exploring US Bank’s specific mortgage rate offerings

US Bank offers a diverse range of mortgage rate options tailored to meet the needs of various borrowers. Their fixed-rate mortgages provide the security of consistent monthly payments over the life of the loan, with terms typically ranging from 10 to 30 years. This predictability makes them a popular choice for those planning to stay in their home long-term.

For borrowers seeking lower initial payments, US Bank’s adjustable-rate mortgages (ARMs) might be an attractive option. These loans start with a fixed rate for an initial period, often 5, 7, or 10 years, before adjusting periodically based on market conditions. This structure can benefit those who expect to move or refinance within the fixed-rate period.

US Bank also offers government-backed loans, such as FHA, VA, and USDA loans. FHA loans are ideal for first-time homebuyers or those with lower credit scores, as they feature more lenient qualification criteria and lower down payment requirements. VA loans cater to veterans and active-duty military personnel, often offering competitive rates with no down payment. USDA loans are designed for rural homebuyers with low-to-moderate incomes, providing affordable financing options.

Exploring these offerings allows potential borrowers to find a mortgage product that aligns with their financial situation and homeownership goals, supported by the reliability and expertise of US Bank.

8. Customer reviews and experiences with US Bank mortgages

Customer reviews and experiences with US Bank mortgages highlight a range of feedback, reflecting the diverse experiences of borrowers. Many customers appreciate the competitive rates and variety of mortgage products offered by US Bank. Fixed-rate mortgages are often praised for their predictability and stability, providing a reliable payment structure for long-term homeowners. The flexibility of adjustable-rate mortgages (ARMs) is noted by those who benefit from the lower initial rates, especially if they plan to move or refinance before the rate adjusts.

However, some reviews mention challenges with the mortgage application and approval process. A few borrowers have reported delays and complications during the underwriting process, which can be frustrating. On the positive side, US Bank’s customer service is frequently highlighted for its helpful and responsive support, with many customers noting that representatives are knowledgeable and willing to assist throughout the loan process.

Government-backed loan programs, such as FHA, VA, and USDA loans, receive mixed reviews. While these programs are appreciated for their accessibility and lower down payment requirements, some borrowers have experienced bureaucratic hurdles or longer processing times.

Overall, customer feedback underscores the importance of thorough research and clear communication with US Bank representatives to ensure a smooth mortgage experience. Prospective borrowers are encouraged to consider these reviews and weigh them against their personal needs and preferences when choosing a mortgage lender.

9. Conclusion and final thoughts on US Bank mortgage rates

In conclusion, understanding and navigating US Bank mortgage rates is crucial for making informed home financing decisions. US Bank offers a range of mortgage products, including fixed-rate and adjustable-rate mortgages, tailored to meet different borrower needs and financial situations. Fixed-rate mortgages provide stability with consistent payments, while adjustable-rate mortgages offer lower initial rates with potential for future adjustments. Government-backed options like FHA, VA, and USDA loans add further flexibility for specific borrower groups.

Current mortgage rate trends indicate fluctuations influenced by economic conditions and Federal Reserve policies. By staying informed about these trends, borrowers can better time their mortgage decisions to secure favorable rates. Key factors influencing mortgage rates include credit scores, debt-to-income ratios, and broader economic indicators. Qualifying for the best rates involves maintaining a strong credit profile, managing debt effectively, and saving for a substantial down payment.

When selecting a mortgage, consider factors such as loan type, term length, and overall costs to find the option that best aligns with your financial goals. Customer reviews highlight both positive aspects and potential challenges, underscoring the importance of thorough research and clear communication with US Bank representatives.

By carefully evaluating US Bank’s mortgage offerings and reflecting on customer experiences, you can make a well-informed decision that supports your homeownership aspirations and financial well-being.

ugodj.com